It’s common knowledge that the biggest banks just keep getting bigger, but that doesn’t necessarily mean they’re getting better. To be successful, community banks and credit unions will need to emphasize their competitive edge over the larger nationwide banks if they want to thrive.

These differentiators include:

- Adopting a retail mindset

- Connection to the community

- Personal relationships with customers and members

- Ability to tailor their services to their customer base

- Creative freedom with their brand

- More opportunity for growth and customization

- More freedom to adapt to customer needs

At Element, we work with branches to create a welcoming and functional physical environment that helps them cultivate better relationships with their customers and members. Tangible elements like multi-skilled tellers, clear wayfinding signage, digital check-in tools, and even a dedicated liaison who can greet visitors at the door and guide them to the right service can catapult community banks and credit unions beyond their behemoth competitors.

Efficiency, technology, and great human capital — these are the pillars of successful branches. Let’s dive into the details.

The Current State of Banking

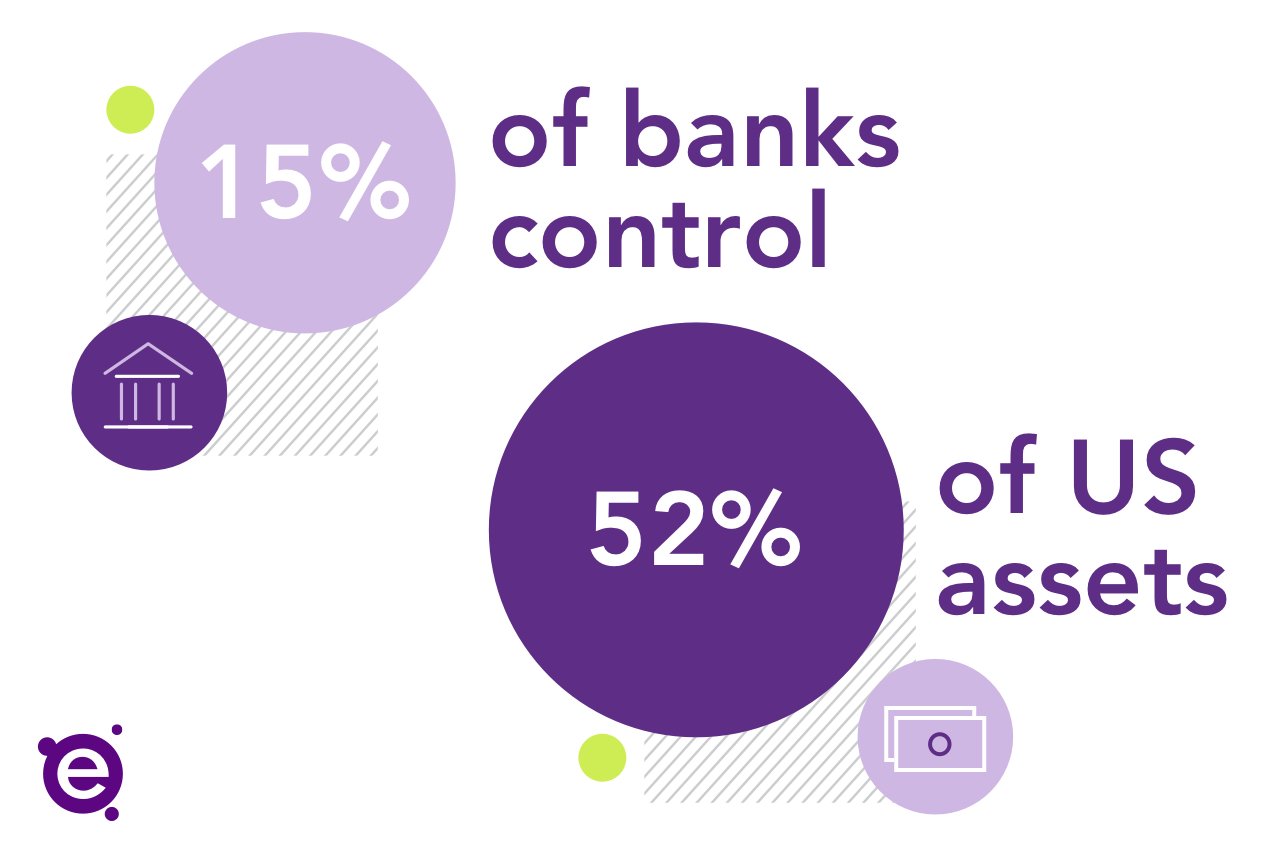

Today, 15 percent of banks in America control 52 percent of the country’s assets. These banks may have household names, but their primary differentiator is their size. This means that smaller, independent banks and credit unions have an equal opportunity to become their communities’ financial institution of choice with the added bonus of having stronger ties to the locale and its people.

According to Bain & Company, the highest returns are netted by one-third of the branches in any given network. These branches can be classified into four “types”:

- Flagship branches serving as brand anchors

- Showrooms for complex product sales and venues for trusted expert advice

- “Hub” branches in central locations that are smaller versions of flagships

- Specialist branches catering to distinct groups, such as small business owners or retirees

“I think as an industry, we hear about all of these things that can be done,” says Element co-founder Nate Baldasaro. “But that doesn’t necessarily mean we should be using it or that we have to use it.” In other words, community banks and credit unions need to capitalize on the right tools over the newest tools or a bigger footprint.

“They’re asking ‘How do I become bigger?’ when the question should be ‘How do I use my space better?'” says Baldasaro. The industry can’t simply return to pre-COVID operations, but right-sizing, prioritizing digital fluency, and smart hiring practices will carry today’s banks and credit unions far into the future.

Adopting a Retail Mindset

To succeed in the future, branches need to stop thinking like bankers and start thinking like retailers.

The most successful retail environments are built around engagement, discovery, and brand storytelling. Why shouldn’t the branch experience be any different?

From the moment a visitor sees the branch from the street to the moment they walk out the door, every touchpoint should be intentional, just like a retail environment. This means creating intuitive zones, using digital signage to keep content fresh and relevant, and training staff to greet, guide, and connect just like a great retail associate would.

As I put it, “If you don’t think your branch is a retail store, you’re missing the boat.” This mindset shift is essential for institutions that want to stay relevant in a fast changing future.

From Order-Takers to Advisors: Embracing a Consultative Mindset

Successful branches of the future will shift from transactional service to a consultative, education-first approach. When working with clients now, the most impactful branches are those where visitors walk out smarter than when they walked in.

This mindset reframes the branch not just as a place to complete tasks, but as a space to learn, engage, and build trust. By training staff to ask thoughtful questions, understand life context, and offer tailored advice, branches can deepen relationships and grow wallet share.

It’s not about selling, but about solving, teaching, and connecting.

Greater Focus on Customer-Centricity

A 2019 study by SOTI found that the majority of consumers prefer self-service over human interaction. Whether the desire or the necessity (i.e., COVID) for digital retail interactions came first, consumers now fully expect their FIs to offer convenient, comprehensive remote or self-serve banking solutions.

Anecdotally, most customers don’t visit their bank until they have an issue. So how do you keep customers and members coming into your branches when the waters are calm?

“Financial institutions should view branches not as transactional business centers but as relationship-focused customer experience stores,” says Nicole Machado, Executive Director of Product Strategy at Harland Clarke. Whether they understand it or not, financial institutions are highly retail in nature, and therefore are held to much the same standards to which consumers hold their favorite stores; those standards include having a memorable experience in the physical space.

Interestingly, younger generations who have grown up with technology (“digital natives”) are just as likely as older generations to visit a physical bank or credit union, especially when it comes to more complicated services. Face-to-face interactions with banking staff provide security and confidence and add value to the customer’s experience.

At Element, we’ve long advised our clients to spin their retail spaces into hubs for financial guidance, consultation, and education — and leave the straightforward transactions to their apps. Going forward, branches will still need to prioritize self-service tools, but integrating technology with in-person interaction solidifies an institution’s ability to meet all customers’ financial needs.

In order to deliver on and exceed expectations, remember:

- Relationships matter

- Human touch remains crucial to banking

- Empowering your employees leads to more customer engagement

More Digital Tools in a Physical Space

Digital banking is going to continue to grow. However, according to Forrester, 80 percent of banks reported in 2019 that they didn’t have the technology necessary to meet customers’ expectations. Considering that finance is becoming increasingly digital, why is the industry so slow to adapt?

“When we talk to these banks about technology, it’s not so much that they have to have everything today,” says Baldasaro. “But the fact is, if they are not looking at this stuff now, when the time comes and they need it, they’re going to be so far behind it’s not even worth the effort.”

Baldasaro says that, although most banks have fairly effective apps and websites, the tech connection often stops there. “When we start talking about in-branch video banking and those sorts of things, their hesitancy is the cost of implementation, because it’s a whole different way of banking,” he says. For example, video banking still requires a dedicated space, video conferencing capabilities, backdrops, and an on-call expert.

“We always say it’s hard to put your toe in the water with this stuff,” Baldasaro says. “You have to buy into it. And you have to market it.”

Redeployed Branch Employees

The term “universal banker” has been tossed around a lot in recent years, but what does it actually mean? Flashy name aside, banks and credit unions have a growing need for the transactional tellers of yesterday to become the highly skilled financial advisors of tomorrow.

Just as with physical space, FIs of the future will need to do more with fewer employees. This means making more selective hires, training tellers on a wide range of financial services, and paying them higher wages. Customer service skills will be paramount for bank and credit union employees, since customers and members visit physical branches to access more personalized financial services, such as taking out a mortgage or a small business loan. Most, if not all, employees should be trained to deal with more complicated and nuanced customer issues, thereby adding value to the face-to-face interaction.

Banks and credit unions of the future will need to empower their staff to:

- Educate customers on financial literacy and banking technology

- Access and understand the same information as customers and specialists

- Become fluent in digital banking and analysis tools

- Transition between financial services (or have easy access to other staff members who can deliver more specialized services)

Since 43 percent of Americans live paycheck to paycheck, financial literacy and advising is more important than ever. Even by raising wages, banks and credit unions who implement comprehensive staff training programs will be able to reduce their overhead, decrease their turnover rate, and keep and attract loyal customers.

The Future of the Branch

According to Moven founder Brett King, we are entering the age of Banking 4.0. This iteration of banking holds the customer-first approach in high regard, as well as the FI’s ability to offer curated services that go beyond banking. It’s this pressure to diversify that often freezes smaller banks and credit unions in place.

All FIs are heavily regulated, which makes it difficult for smaller, independent institutions to differentiate themselves and their services. Plus, fintech and direct banking (like Zelle and Venmo) enter consumers’ lives in much more organic ways through targeted ads or peer influence. However, since 77 percent of Americans admit to some level of financial anxiety, in-branch or digital banking assisted by a consultative expert can be the ideal remedy.

COVID-19 brought permanent changes to the banking industry, but not all are detrimental to the physical branch. In their 2021 Banking Strategies Executive Report, BAI predicts that:

- Self-service technology will be better integrated into physical branches

- Banking by appointment is here to stay

- Touchless technology is going to continue to grow

- Face-to-face or video “advisory pods” will become a branch staple

- There will be fewer, smaller branches in each network with a larger focus on consultative services

- Branch design will be more reflective of their trading area

- Banks and credit unions will increasingly invest in financial education

- More banks and credit unions will adopt a data-driven approach to attracting and keeping customers and members

In short, the physical branch will remain intrinsic to the banking experience for years to come. Make sure your branch is poised to embrace the future.

Branch Floor Plans

If you think of your physical branch as a billboard for your brand, the space becomes a dynamic marketing opportunity. Even if they can’t compete with the major banks, smaller banks and credit unions can still optimize their footprint and adopt technology that positions them as worthy competition.

We’ve seen that successful branches divide their physical spaces into distinct zones that guide the customer experience:

- Self-service

- Educate

- Advise

- Partner

- Transact

“The branch is still where the bulk of all opening transactions take place,” says Baldasaro. “But if I’m Nate’s Bank and Trust, and I have 12 branches, I’m thinking: How am I going to compete with the big banks? My physical location is a differentiator.”

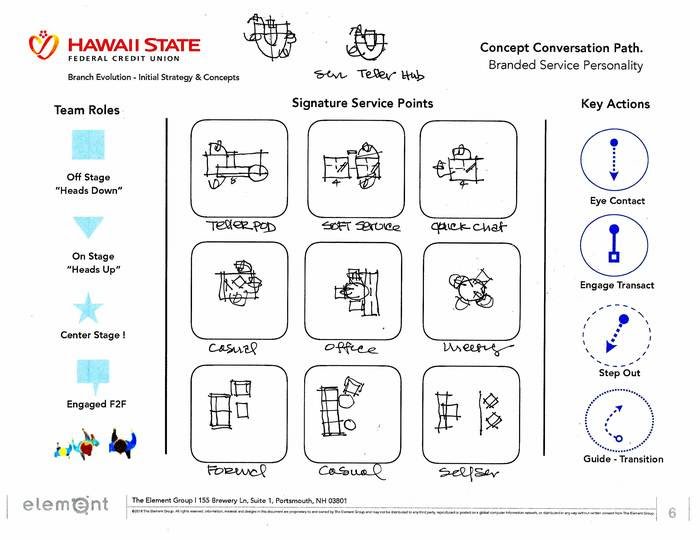

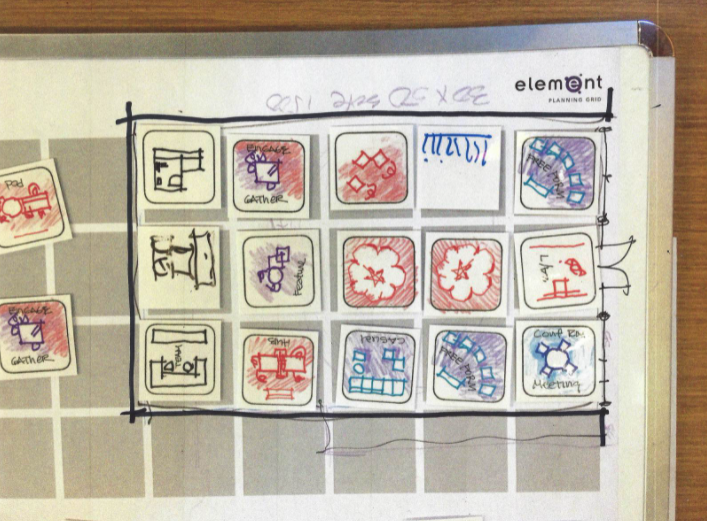

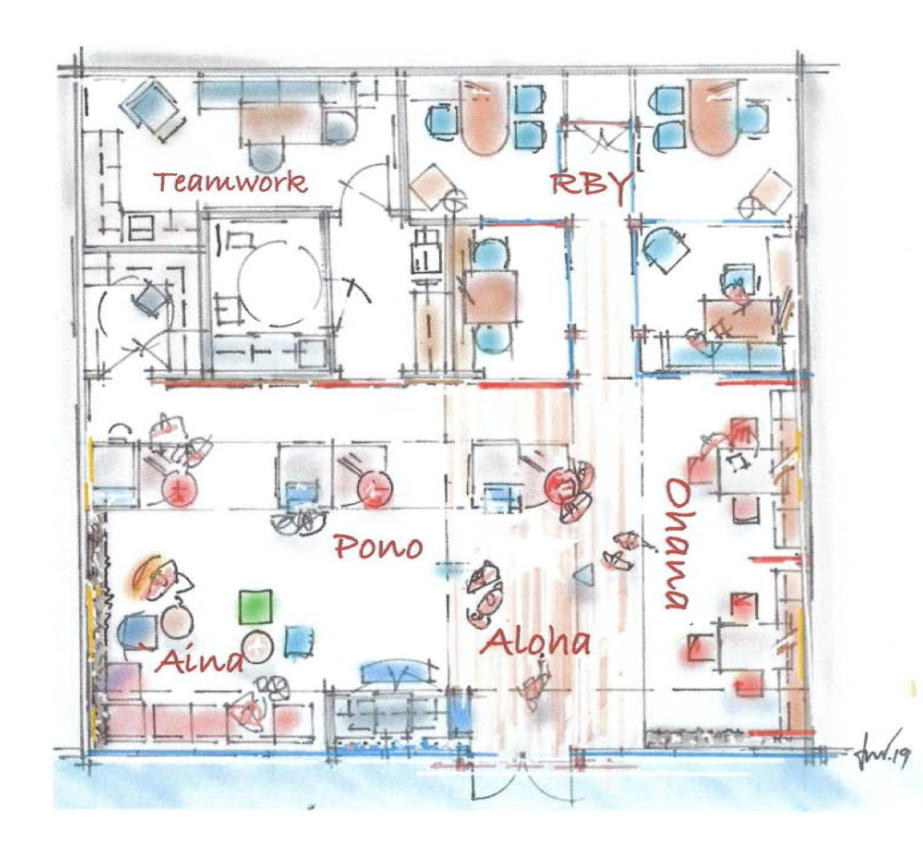

With the help of a strategic layout and smart interior design, a branch with a 1500-square-foot space can become an all-hours advertisement for banking services and technology. When we design or remodel a space, we guide our clients through a series of exercises to help them identify the ideal solutions for their branch. Take a look at our approach to Hawaii State Federal Credit Union’s physical upgrade:

First, we determined the “zones” of their physical space, including spaces for self-service, quick chats, and meetings. We assigned each space to a paper square and included a selection of “choreography” actions: Step Out, Guide/ Transition, etc.

Next, we had our client cut these squares out and physically arrange them on a scaled-down footprint of their space. Team members could weigh in with their suggestions and experiment with arrangements as a group.

This exercise helped us create a proposed floor plan for the updated space.

See the finished product — complete with interactive touch tables, digital signage, and new furnishings — here.

More Examples from Our Clients

With a constant eye to the future, we help our clients enhance the customer and member experience, streamline their operations, and increase their profitability. Meet some Element clients who have taken the leap into the future of banking.

- Small footprint, big impact: Merrimack County Savings Bank

- 24-hour member engagement: Denali Federal Credit Union

- Innovation meets convenience: UMassFive College Credit Union

- Cross-training staff for a digital future: Hawaii State Federal Credit Union

- Engaging customers from the ground up: Popular Bank

- Signage that reaches beyond walls: Inspirus Credit Union

Ready to find the right solution for your financial institution? We’d love to hear from you.