Anyone who’s ever walked into a bank or credit union branch is familiar with banking brochures. They’re stacked on the deposit slip station, propped up along the teller counter, and arranged neatly on every loan officer’s desk. But once a customer or member picks up a brochure, there’s no telling how they’ll interact with it once they leave the branch, or whether the information inside will have an impact on their buying behavior.

Now, there’s a new kind of brochure in town. The digital brochure experience aims to re-engage customers and members while providing institutions with valuable insights. It’s an essential piece of bank and credit union marketing, reinvented.

Why Digitize a Brochure?

We live in a digital-first world. In retail banking, fixtures like paper applications and deposit slips are giving way to interactive PDFs and app-enabled mobile check depositing. The banking public can now access any information they need through an institution’s website, app, or at a digital display kiosk — or at least, that’s what they expect.

The paper brochure (another fixture) has long been an excellent marketing tool for educating customers and members. These little cards, trifolds, or booklets are compact, portable, and easily displayed at high-traffic locations; they also work to extend a visual brand and disseminate information beyond the branch. However, paper brochures aren’t necessarily the most practical or innovative way to share information. They can be easily lost or damaged, and the time it takes to produce new versions or update the content can be a hassle.

Digital signage brochure displays, on the other hand, set a new standard by being paperless, engaging, accessible, easily customizable, and able to capture customer data. In short, this innovative banking technology enables institutions to do so much more than a physical brochure could.

How Does It Work?

A digital brochure display uses touchscreen technology to engage and inform users in place of a physical brochure.

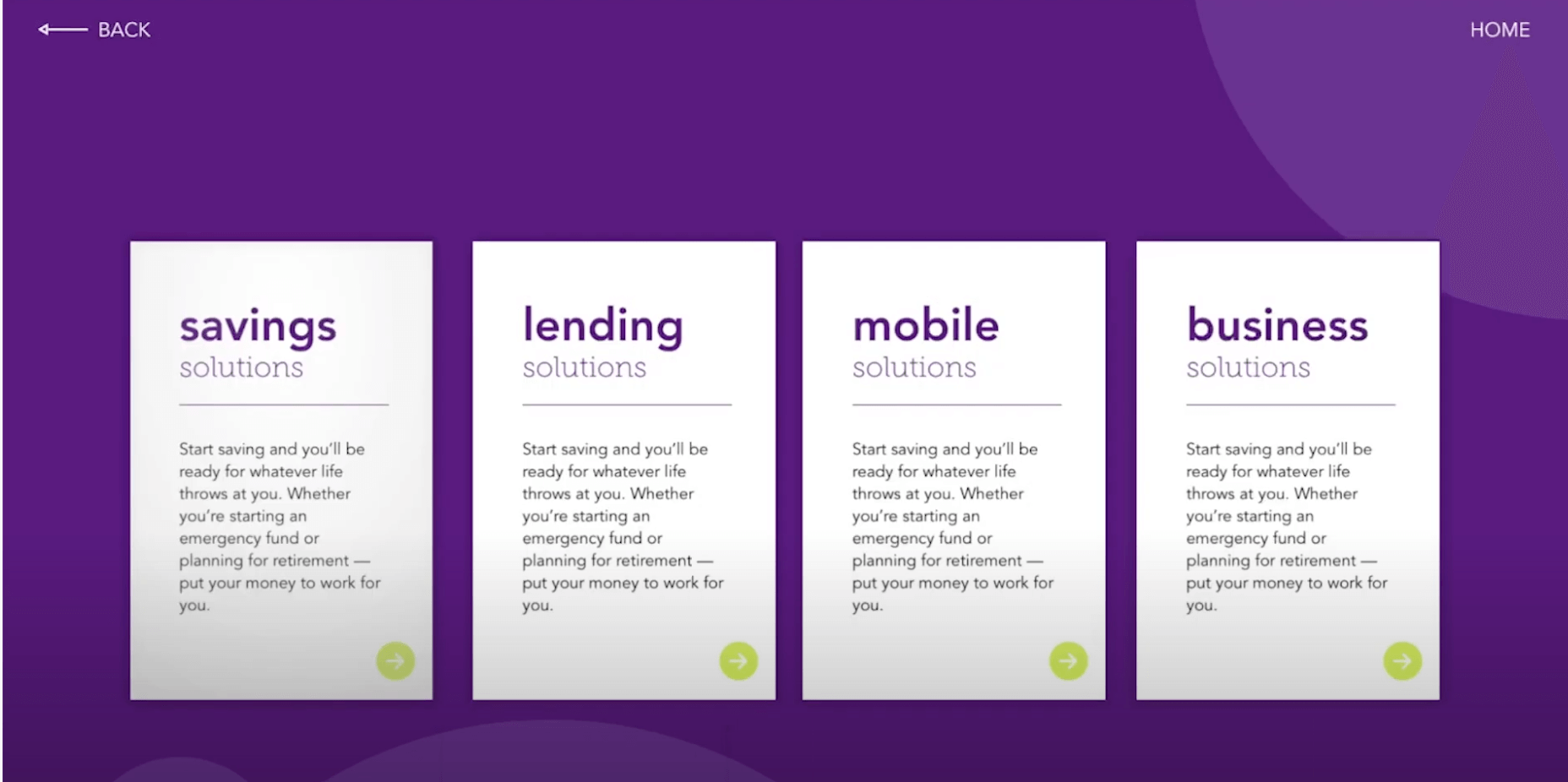

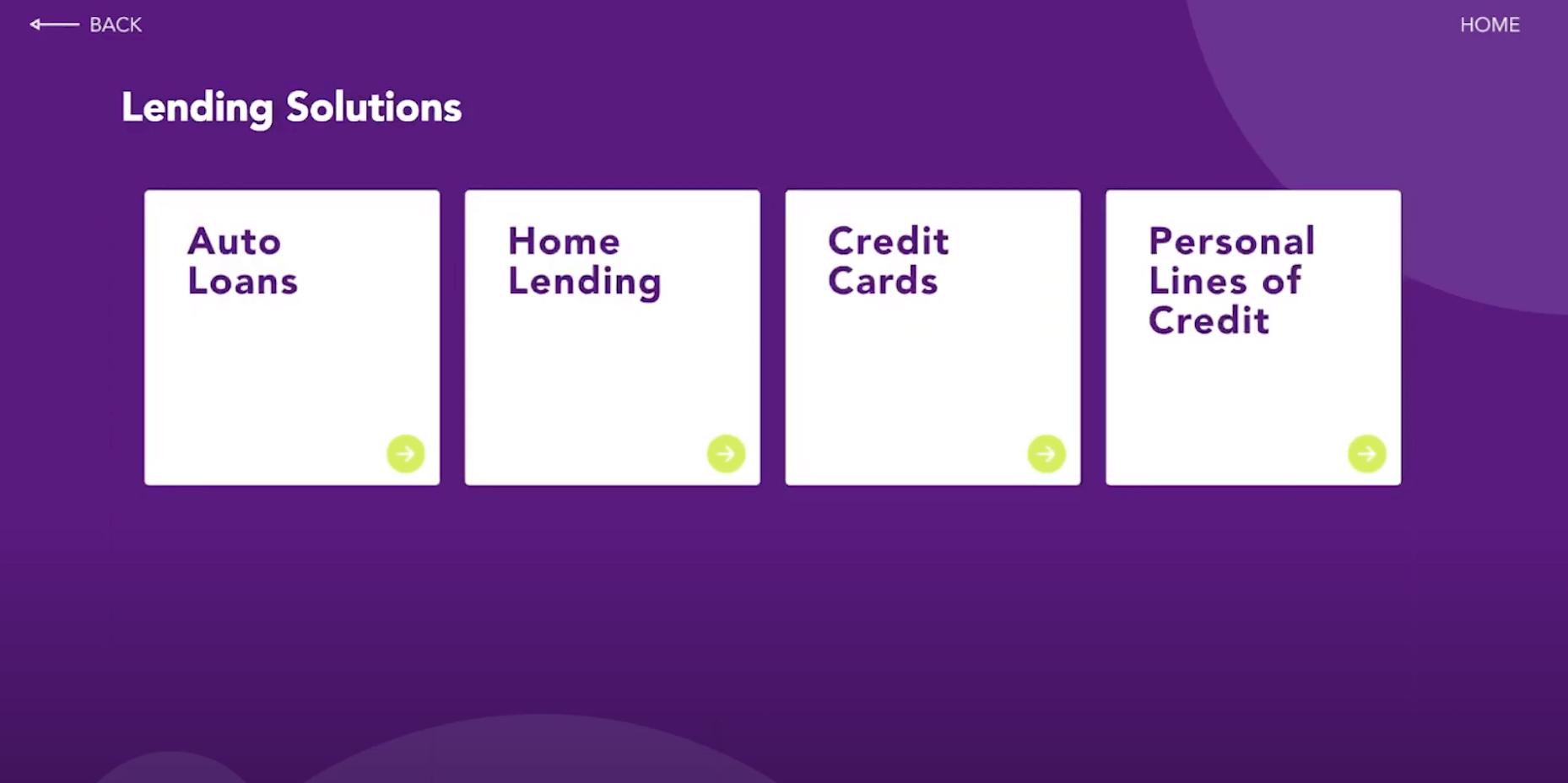

Let’s say a customer visits their bank to learn about home lending products. Once they arrive at the branch, however, they realize they completely forgot about an appointment across town that starts in fifteen minutes! Without much time to spare, they approach the digital brochure display and navigate to the applicable category — in this case, Lending Solutions.

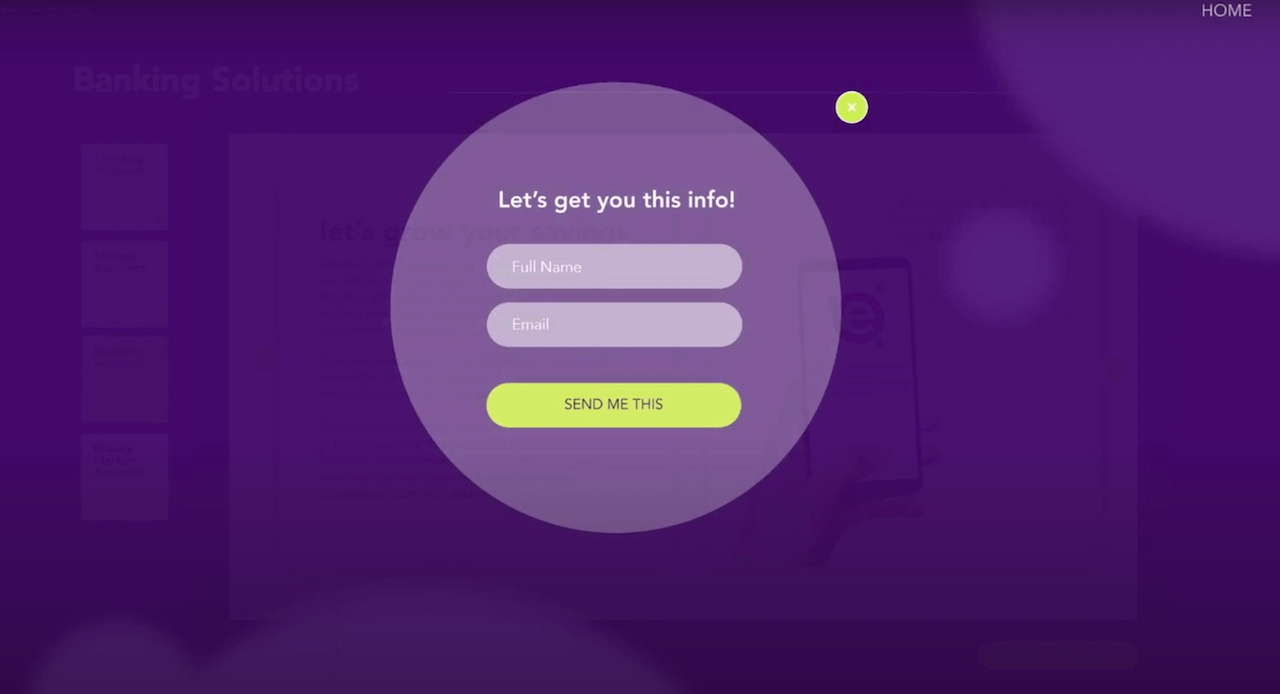

They then select the Home Lending digital brochure and click the button to send a PDF version (or other preferred format) straight to their email.

They enter their full name and their email address, click Send Me This, and they’re done!

The customer is in and out the door in five minutes, with all the information they need tucked safely in their inbox. If they had additional time, they could also read through the information on the screen, navigating seamlessly between files and categories as they pleased.

Watch this demo to see the process in real time:

Not only does this experience promote ease of use for the customer or member, but it enables the bank or credit union to gather data about their clientele.

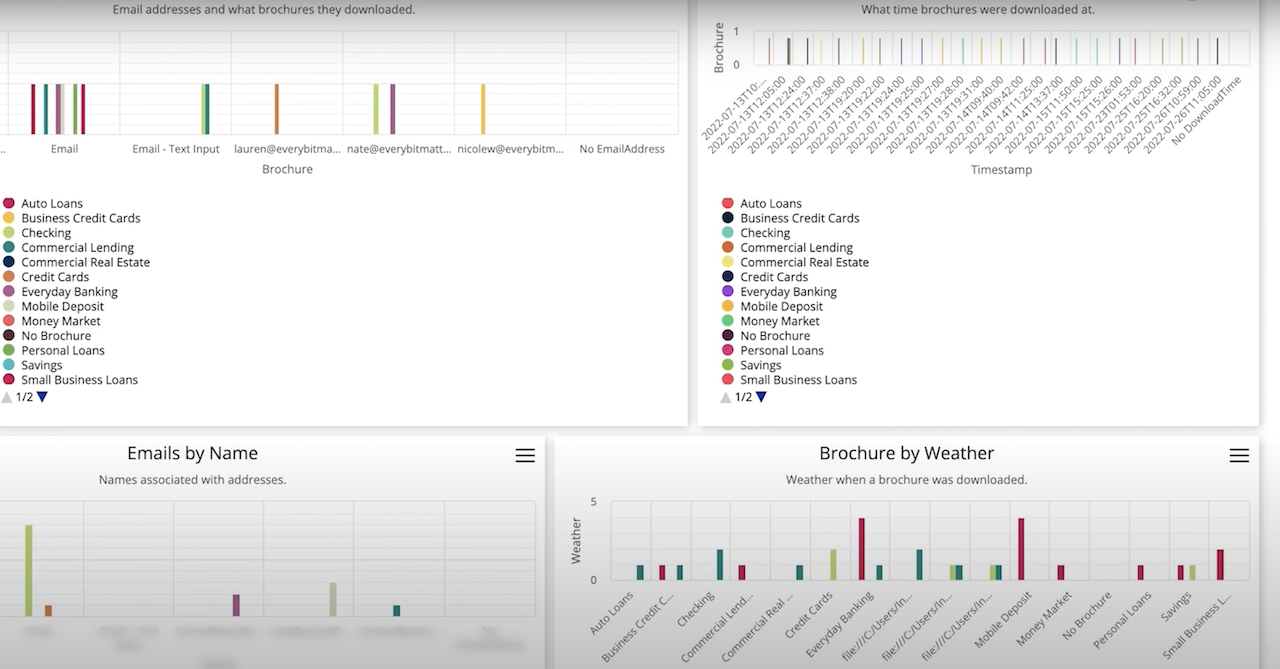

As the user navigates the digital experience, the interface collects and securely stores a record of their actions. When the user enters their email address to receive a brochure, the program enables the bank or credit union to collect:

- Contact information: The user’s first and last name and email address.

- Area of interest or need: The specific brochure(s) accessed.

- Time: Both the time of the download and how much time the user spent reading the brochure(s) onscreen.

- Location: Where the user downloaded the brochure.

All of this data can be easily exported into spreadsheets, PDFs, etc., which can then be shared to network or branch leadership and marketing teams. The digital display program can even organize and display data in easy-to-read charts and graphs, allowing marketing teams to track KPIs such as:

-

- The download traffic at various branch locations

- How many users did not download a brochure

- Which brochures received the most engagement

Even if an in-branch user refrains from entering any personal information, the program can still track the user’s interactions with the experience and categorize them according to existing data.

Collecting this information helps branch management and marketing teams tailor products and services to their customers’ needs and preferences. When a bank or credit union is able to meet and even predict those needs, it helps to establish better relationships and build trust with customers and members.

Features and Benefits of Digital Brochure Displays

This digital experience provides valuable insights for both the user and their bank or credit union, who can leverage new and traditional marketing methods to reach a digital-first audience.

The digital brochure experience delivers the following features and benefits:

- The digital signage brochure program can hold an unlimited number of files.

- Digital displays save on both printing costs and physical counter space.

- Touchscreen technology offers customers and members a fast, dynamic self-service option.

- Users can share brochures with others by entering that party’s email address.

- An intuitive content management system (CMS) enables staff to easily add, edit, or remove brochure files.

- Policy changes, design improvements, and updated branch information can be communicated in real time.

- Implementing new content is fast — updates can be pushed live within minutes, or scheduled to upload at a certain time.

- Once uploaded to the CMS, the content is viewable at any branch with the same digital signage brochure display.

- Brochures can be exported as PNG, JPEG, SVG, PDF, CSV, and XLS files.

How Element Can Help

Our goal at Element is to get to know your organization, the needs of your employees and customers or members, and your institution’s place in the community. Once we gain a complete understanding of your institution’s customer or member journey, we begin to strategize how to effectively implement the right solution or combination of solutions to engage and support.

Digital signage brochures are an easy, convenient, and innovative way to educate your clients and track meaningful information for your team, all in a matter of minutes. If this sounds exciting, we’ve got plenty more creative and engaging ways to enhance your customers’ or members’ experience. Check out our services or send us a message to request more information on digital signage and digital brochures!