In the first part of this two-part series we discussed some of the current technology applications businesses are using to create an efficient and convenient digital experience for their customers, as well as, the ability of the business to gather essential information that allows for a better and more targeted line of communication with their customers. As mentioned, the information a business is able to gather about individual customers is priceless and usable in countless ways. Let’s quickly examine how grocery stores use this type of information, as the grocery industry is masterful at capitalizing on information they are able to analyze and then provide targeted incentives to customers based upon their shopping history and habits. Most of the reward programs offered by grocery stores are now driven by the same technology as the business apps being developed. Grocery stores are able to gather a tremendous amount of information about each consumer that they can track and immediately know when a customer shops, what they buy, how much they spend and if they have been absent from the store. Grocery stores are then able to send a coupon, personalized messages and invitations that speak directly to a consumer based upon their shopping behavior. Now that we’ve made our point about the importance of utilizing this type of technology we will outline six technology services that will get you on track creating a better experience for your customer and more powerful marketing and promotion capacity for your bank.

Digital Appointments:

Per previously mentioned examples of most service based businesses offering scheduling abilities from their mobile device we can offer you Digital Appointment capabilities, of which will allow customers to schedule an appointment via and app within a calendar of available times. The scheduled appointment appears on the bank computers alerting a representative to the scheduled appointment. Upon arrival, the customer checks in via the app alerting the representative that the customers is in the building. This app can be developed as simple or as robust as desired by the bank.

Creating A Digital Connection:

This function allows a customer to bank they way want while also providing the bank with a tremendous amount of information about this particular customer. The primary purpose is for customers to make notes about various questions and thoughts about their accounts or bank offered services. The bank also has the ability to make notes about the customer that can be used for future follow up, direct messaging and an overall better rapport.

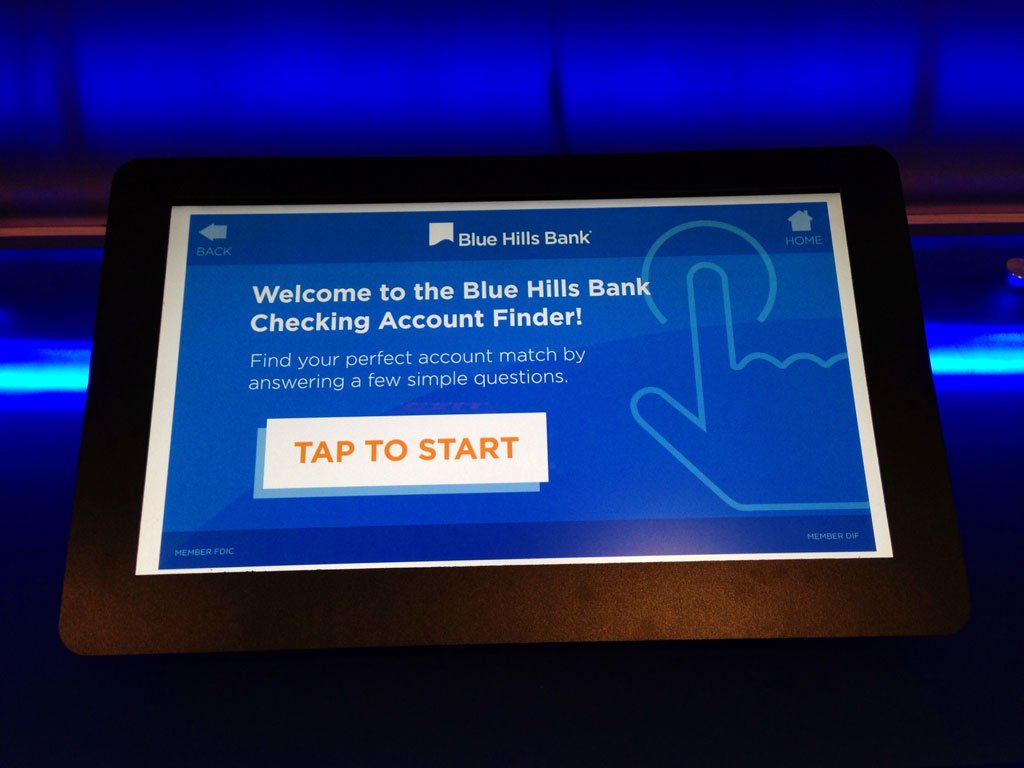

Account Finder:

This function provides the customer the ability to browse various products and services offered by the bank that are targeted to them based upon how they answered a few questions. If the results of a questionnaire provide insight that a customer is interested in learning more about mortgages they will be presented with mortgage based information. The customer then has the option to download the information, email to themselves or share with someone else. The customer can fill out any applications or documents necessary prior to arriving at the bank making the process very efficient for both parties. The bank is also able to track the items customers downloaded and is therefore able to content them to discuss in greater detail or inspire them to continue with the process. It is a tremendously powerful sales tool for a bank.

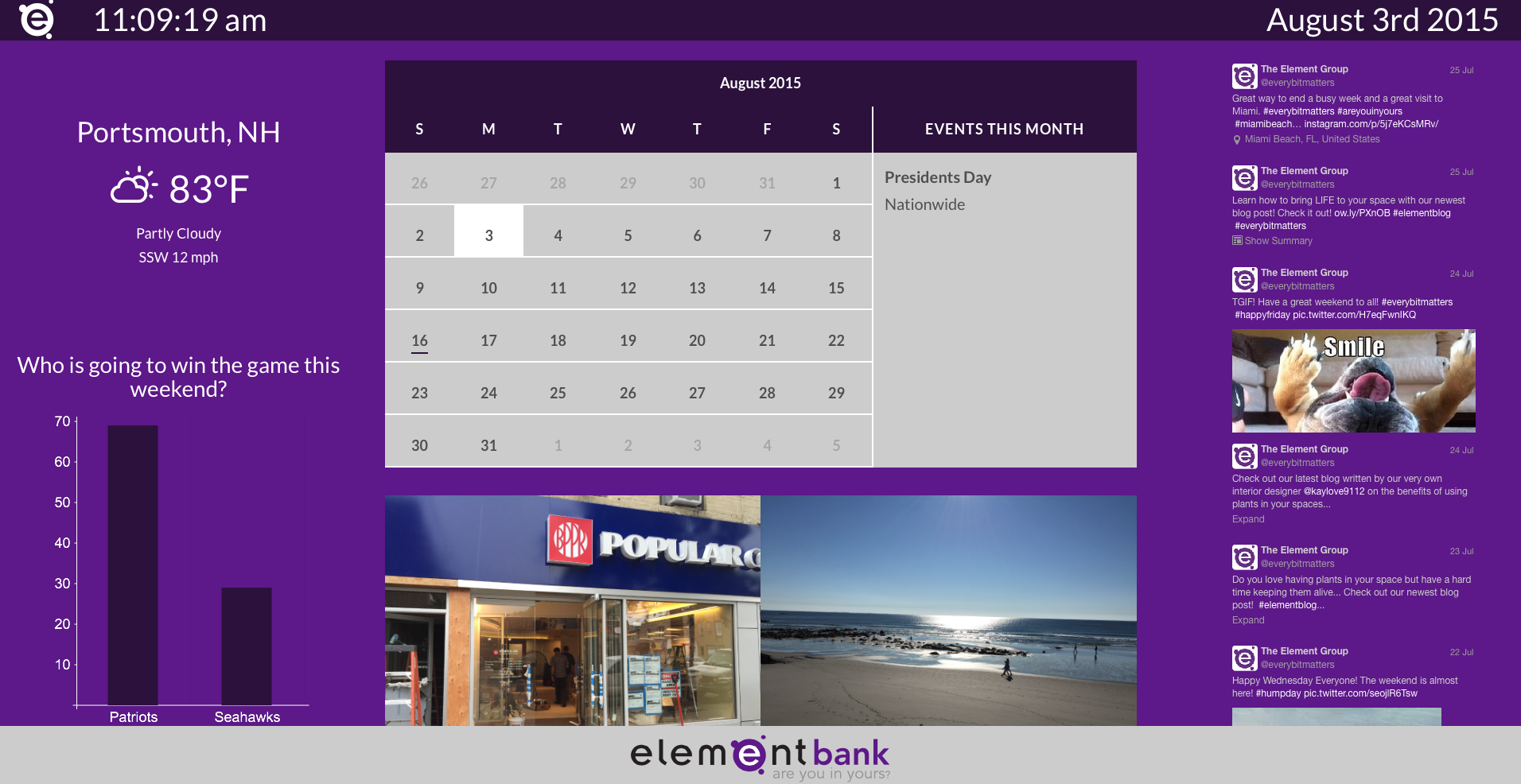

Live And Interactive Widget Wall:

A live and interactive widget wall is primarily a function proven by consumers as something they want. This is the added value stuff, we mentioned, but it is also a great resource for interacting with your customers while also being a go-to page for banking information and otherwise. Featured are an interactive calendar, the date and time, local weather, trivia, sports scores and potentially advertisements either from the bank or outside businesses. Real time information about upcoming events, area web cams and social media posts and tweets being made by the bank and customers. You can post an online poll about upcoming cultural events that result in customer interaction within your brand. This function is what is referred to as the random scroll though page during idle times, but if you are able to be connecting and communicating with your customers as a result it provides and opportunity you don’t otherwise get. Keep in mind we can customize this wall to be relevant to your bank and community.

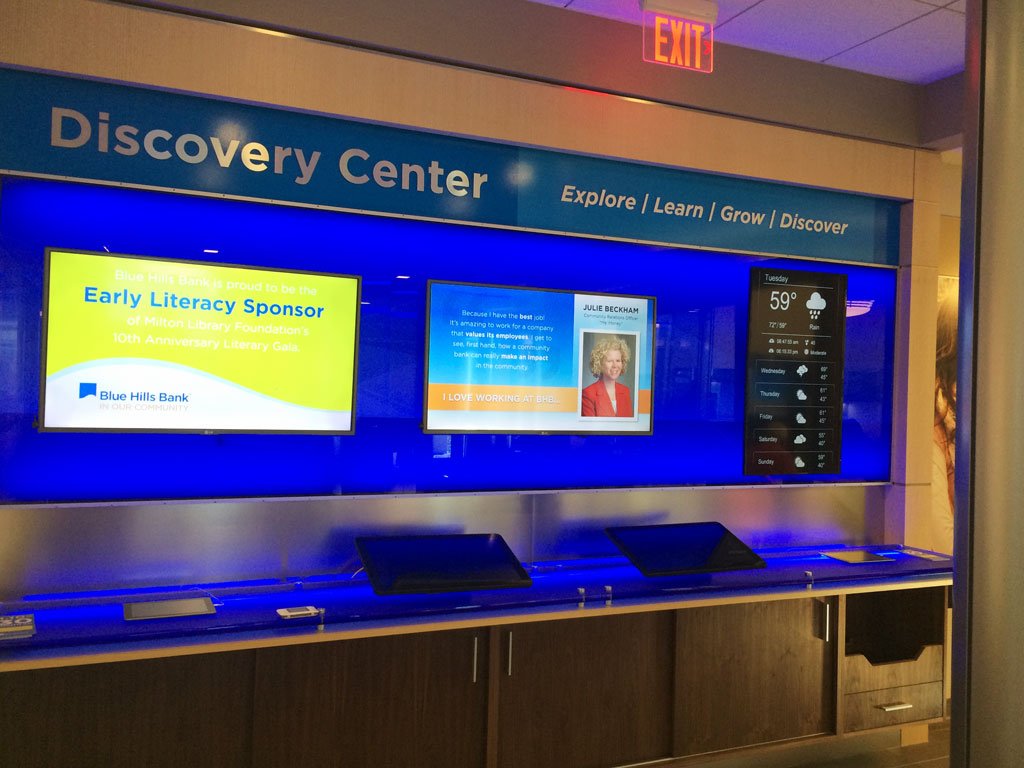

In-Branch Screens:

It is not uncommon for businesses to have flat screens featuring digital displays, but our service allows these screens to become interactive. Consumers are able to click through a menu of options and narrow down the information to their interest. Upon finding something of interest, the consumer can download the information to their device, which is also digitally tracked by the bank. If a customer downloads information about a checking account the bank can proactively follow up with the customer with more information about checking accounts. This service is very powerful in establishing dialogues with the customer based upon items they have shown interest in knowing about.

Blue Hills Bank

Rivermark CU

Denali Alaskan CU

Blue Hills Bank

Digital Referral Program:

Referral programs are not a new banking tactic, but offering this incentive digitally is new. In this day in age, traditional referral programs are cumbersome and appear as a chore rather than a bonus. We can offer you the ability to establish the referral program via digital applications that happen instantly. A person is much more likely to take advantage of a referral program if they can solicit to all their friends at once via social media rather than tracking others down and pitching it one at a time.

It is our intention to outline some of the current technology apps that we, The Element Group are implementing in banks throughout the country, but is more of our intention to speak with you directly about helping you take advantage of these functions that are proving successful in creating a more efficient and fluid banking experience for your customers while allowing you the ability to be more targeted and effective in communicating with your customers.

These are six bits of technology that will transform how you and your customers do business together and as we always say, Every Bit Matters.

—————————————————————————–

Article written by Brent Beckett for The Element Group.

Edited by Lyndsay Reese.