Technology dominates nearly every industry, and banking is no exception. There’s a persistent pressure for financial institutions to innovate in-line with rapidly changing tech, as well as environmental and social changes. All that to say: The way customers engage with banks and access money is not the same as it was even five years ago.

To meet the changing expectations of bank customers and credit union members, financial institutions need to adjust their customer journey map. This blog post will define the useful exercise and provide example steps to consider.

what is a banking customer journey map?

Customer journey mapping is when a visual representation is created to see how your customers interact with your brand, from their initial exposure to becoming advocates themselves of what you do. The exercise is useful for stakeholders to step into the customer journey themselves and see their business from a new, and arguably the most important, perspective.

Creating a customer journey map will ensure that you are effectively reaching your customers at every stage of their involvement. You’ll gain insight into any common customer and member disconnects, allowing you to optimize a consistent customer banking experience.

why is customer journey mapping important?

Dedicating time and attention to a customer journey map can help your financial institution meet some of the most common challenges in the banking space, including:

- Customer desire for instant, 24/7 access to financial services

- Retaining customers in a world of seemingly endless options

- Widespread demand for mobile banking

- Importance of data security and transparency

Laying out exactly what customers are getting and comparing it to their most valued needs will put your financial institution in impressive standing with those you serve.

benefits of creating a customer journey map

Utilizing a customer journey map not only benefits you by providing a realistic customer viewpoint, but it also allows you to make improvements that ultimately allow you to better serve your target audience. The following are just a few benefits to consider:

- Provide services that address real customer and member needs instead of presumed ones.

- Adapt to novel circumstances in which people are using money.

- Develop increasingly personalized interactions throughout service delivery.

- Maintain high levels of confidence and trust.

- Identify more opportunities for interaction with customers and members.

- Safeguard long-term revenue growth.

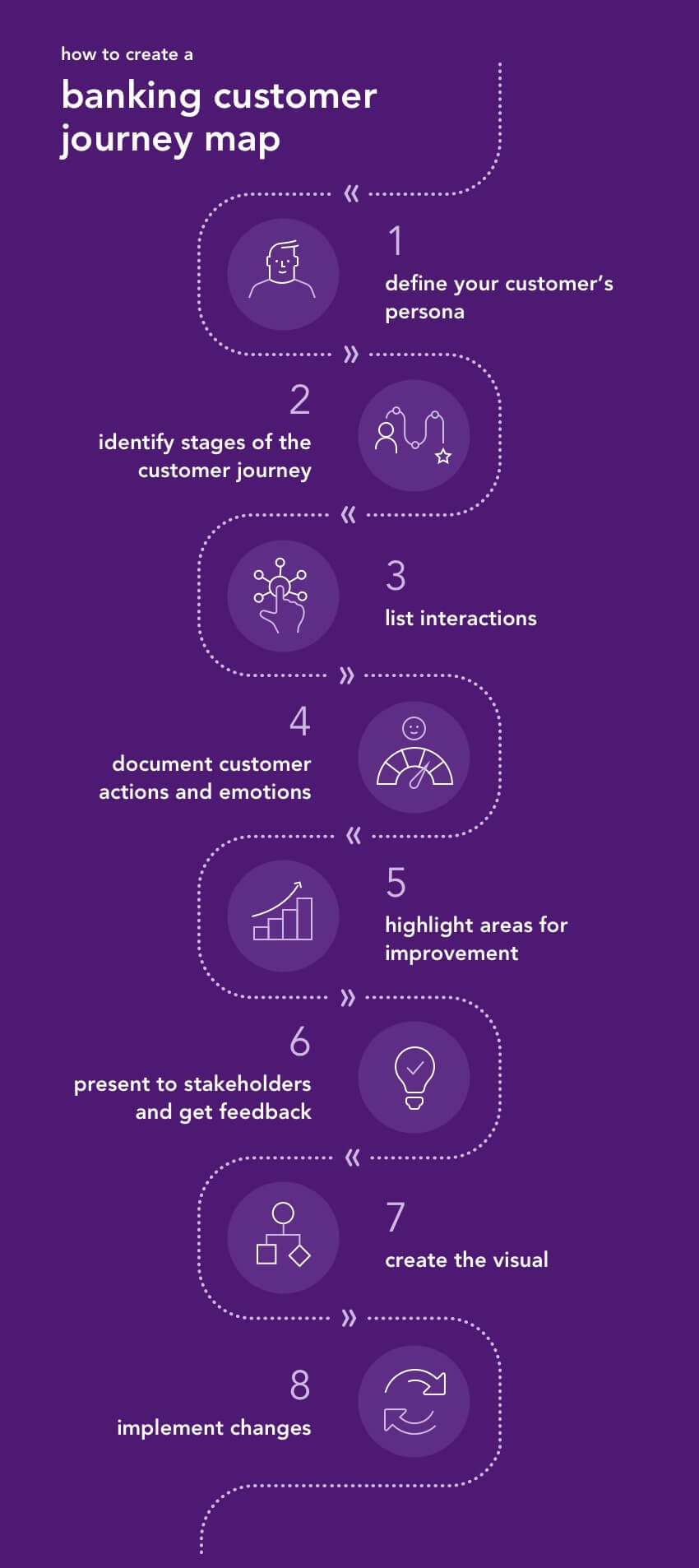

how to create a banking customer journey map

As you start to build your own customer journey map, consider the following steps to understand key touchpoints:

- Define your customer’s persona

It’s important to have a clear understanding of the customers and members utilizing your services. Create a customer persona that represents the characteristics, needs, and behaviors of your typical banking customer. This persona will serve as a reference point throughout the journey mapping process. - Identify stages of the customer journey

With your specific financial institution in mind, write down stages of the customer journey. These are some common ones: Awareness, consideration, purchase (or account opening), retention, and loyalty. - List interactions

Starting from the beginning, where are customers and potential customers seeing and interacting with your business? This includes website visits, social media presence, branch visits, email enrollment, and more. Consider both digital and physical points of contact. - Document customer actions and emotions

Look at the items you listed in the previous step and dive into what the customer experiences during each. For example, is there a clear direction on how to get in touch with your financial institution? Is there confusion about how to open an account, withdraw, or deposit money? - Highlight areas for improvement

Continue to take a hard look at the realities of the customer experience and jot down needed improvements. This could include long wait times, ineffective artificial intelligence (AI) or virtual assistants, a glitch in the mobile app, and more. - Present to stakeholders and get feedback

Collaborate with employees from various departments within your financial institution. It’s their experiences and insights that will help give you a realistic understanding of the customer journey. - Create the visual

A flowchart, storyboard, or timeline are all great options for a banking customer journey map. Whichever you choose, keep it easy to read and understand so information is clear as it is shared around the organization. - Implement changes

Review the visual you worked hard to create, and notice which areas are lacking and which are working well. You will likely end up with a dynamic list to get to work on, possibly including the process of opening an account, mobile banking user experience, and customer support.

tips to improve the customer journey in banking

Know who your customers or members are

Take the time to develop realistic customer personas based on actual banking experiences. Consider these questions to develop a full understanding of who your financial institution is serving:

-

- How traditional are our customers?

- How much human interaction do they require in their banking experience?

- What do their lifestyles look like?

- What channels are best to connect with them?

- How comfortable are they embracing new technologies?

- What digital devices are they using?

Understand the customer’s or member’s needs and pain points

Consider how people are engaging with financial services, in person or on-the-go, and what level of customer support is required for each. Do they know about and have access to all of the resources you offer? In the instances when members are taking their finances elsewhere, what led them to that decision?

Know the steps involved in the customer journey

Put yourself in the customers’ shoes — view the experience from their perspective. A good place to start is with customer-centric offerings, such as digital onboarding and personalized services. Shift people’s expectations of how traditional banking services can be delivered digitally, using the perceived threat of digitization as a means of inspiration to offer your customers more. Financial institutions are giving themselves an edge by staying ahead of evolving bank trends and expectations. Let it be known that your financial institution offers essential services that won’t be disappearing.

Offer seamless experiences across multiple touchpoints

The modern customer values accessibility with ease. In retail banking that can mean implementing a customer relationship management (CRM) system, which allows all touchpoints to integrate and share data without anyone having to dig for information at any point. Financial autonomy has never been valued more than in the modern day, and omnichannel banking is a great way to achieve that.

Optimize the branch experience

To start simply, walk through your branch or credit union and view the physical space from the perspective of a visitor. Branches of the future utilize digital tools, redeploy bank employees to interactions that require humans, and rely on AI when appropriate. Weigh self-service options, including kiosks, to see if they work in your space.

Measure and improve customer satisfaction and loyalty

Each person who utilizes your financial institution has experiences to share. Send out regular customer surveys — to employees and guests — to hear what’s working and what needs improvement. Identify key performance indicators (KPIs), and emulate successes in other applicable areas of the bank or credit union. Be sure to solicit feedback before implementing changes.

Incorporate new technologies

With the popularity of mobile banking, it’s no secret that customers and credit union members are largely embracing technology. Explore the future of banking technology, including AI, chatbots and virtual assistants to assist guests and employees with ease.

At Element, we’re committed to providing all of your design and engagement solutions. Contact us today and a member of our team will happily be in touch! Looking for some more inspiration in the meantime? Check out our 2023 Portfolio, featuring eye-catching displays and practical solutions.